From Darknet market users to scammers and those wanting to hide their nefarious doings online, cross-chain services serve as the perfect method for anybody to launder funds and remain anonymous. While cross-chain services have valuable purposes in the crypto-ecosystem, they’re also a way to bypass all forms of monetary monitoring. This could push regulation into the ecosystem more as cross-chain crime has reached a record $7 billion.

$7 Billion In Crypto Laundered

The value of illegally laundered cryptocurrency through cross-chain crime has reached a record $7 billion, says Elliptic, a cryptocurrency analytical firm. Cross-chain crime refers to a method that involves swapping crypto assets between different blockchains to hide the criminal origins.

Cross-chain also known as “chain” and “asset bypassing” has become one of the most common means of laundering digital assets. The latest “State of Cross-chain Crime” report released by Elliptic has revealed that cross-chain crime is the preferred laundering method for cybercriminals.

Traditional money laundering methods have been targeted by enforcement agencies, which has led cybercriminals to search for new and innovative methods to launder their illicit funds undetected.

- Criminals and high-risk entities used DEXs, cross-chain bridges, and coin swap services to hide $4 billion in illicit crypto proceeds.

- Hackers, dark web markets, online gambling platforms, and ransomware are top illicit crypto users.

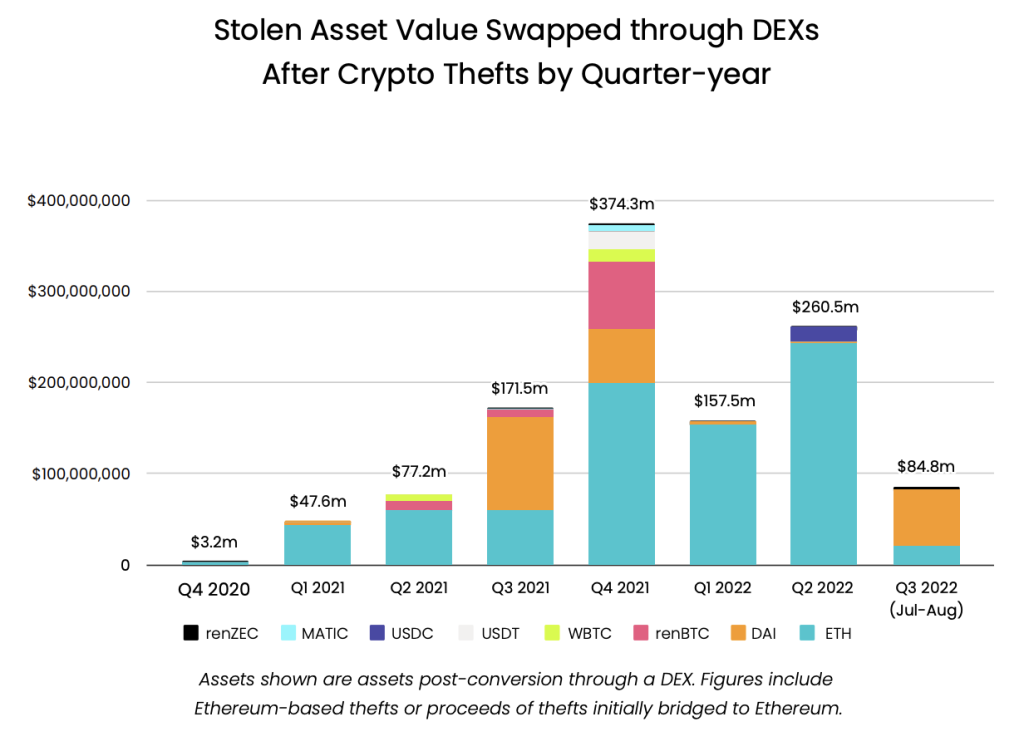

- $1.2 billion stolen crypto swapped via DEXs (over a third of all stolen crypto).

- RenBridge laundered over $540 million in illicit cryptoassets.

- “Coin swap” services laundered $1.2 billion in illicit assets, mainly catering to criminals.

- Sanctioned, seized, and terrorist groups laundered over $1.8 billion through cross-chain and cross-asset techniques.

The latest findings come a year after Elliptic’s “State of Cross-chain” report, which at the given time revealed approximately $4.1 billion in illicit or high-risk funds had been laundered through decentralized exchanges (DEX), cross-chain bridges, and crypto exchange platforms.

The firm predicted that by the end of 2023, the figure would increase to around $6.5 billion and $10.5 billion by 2025. However, 10 months into 2023, the figure has already breached 7 billion and is increasing at a rapid rate. It looks like we’re ahead of schedule.

The period of July 2022 to July 2023 saw over 2.7 billion laundered through cross-chain crime. Additionally, cross-chain crime continued to rise despite the low market value of cryptocurrencies.

According to the report

Onward transactions from the Bitcoin donation address saw almost two-thirds of

Elliptic

donations being sent through a single coin swap service. The same platform has also

been used by numerous dark web entities and carding vendors. The remainder of funds

were sent to exchanges that would not have required KYC verification at the time due

to the low amounts

Why Has There Been an Increase in Cross-Chain Crime?

The increase in cross-chain crime has been influenced by several factors. Firstly, crypto coins have become increasingly popular for cybercriminals. Bitcoin is no longer the only cryptocurrency that carries value, there are thousands of others available.

Private coins, such as Monero (XMR), have slowly taken over from Bitcoin as the number one traded coin on the dark web. Private coins provide cybercriminals with complete anonymity, which makes it impossible for enforcement agencies to trace transactions.

Furthermore, stablecoins (such as DAI, and USDT) are pegged to the price of the U.S. dollar, which offer price stability. The thought of having complete anonymity encourages criminals to launder millions of dollars worth of crypto assets.

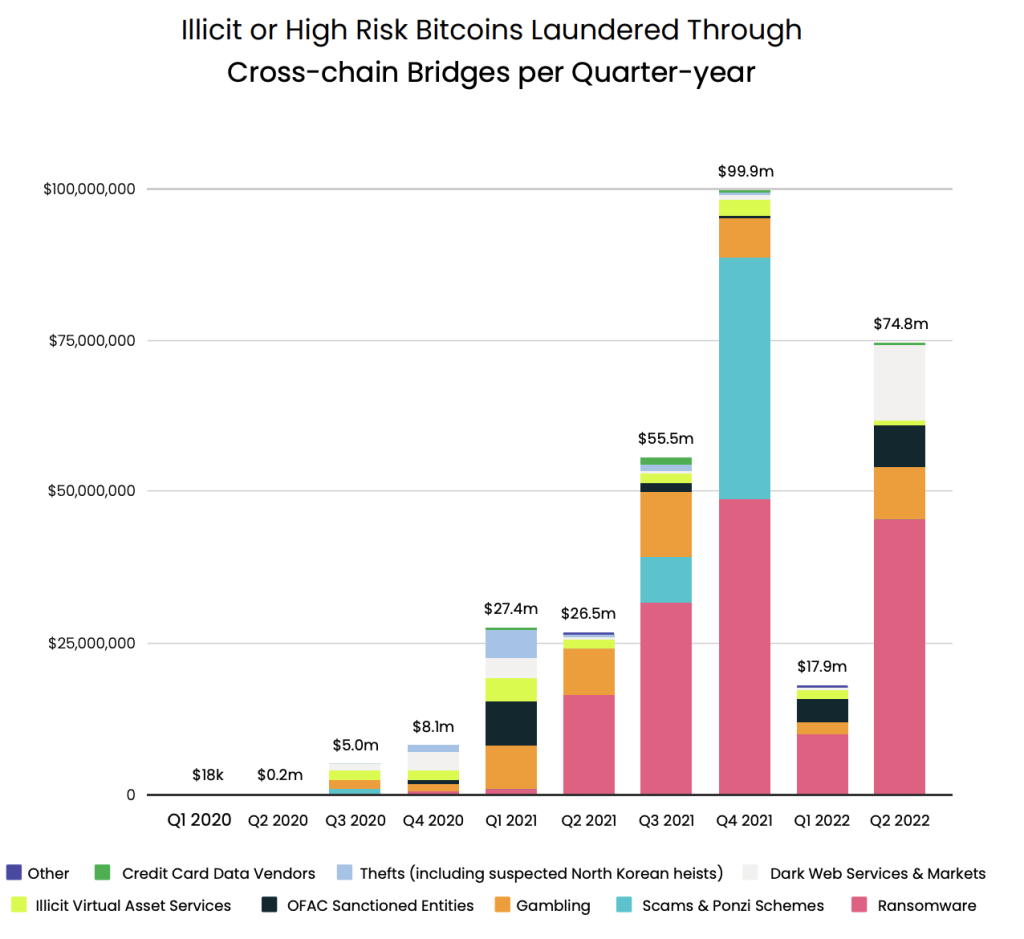

Most recently, the biggest increase in cross-chain crimes is seen in crypto theft, pyramid schemes, scams, and illegal laundering by bad actors. North Korea’s Lazarus Group has been one of the main contributors to the increase in cross-chain crime. The group has been responsible for around 1/7th of all cross-chain crime tracked by Elliptic, having approximately laundered over $900 million using these methods.

Elliptic explained that cybercriminals have shifted away from crypto mixers to cross-chain bridges over the past 12 months. In June and July 2022, the majority of stolen crypto funds were laundered through cross-chain bridges compared to mixers used in the first half of the year.

The criminals trend shifted to a new method of laundering money due to over policing on one method. In August 2022, the sanctioning of Tornado Cash saw The Lazarus Group switching to the Avalanche Bridge. The group reportedly used the same bridge to facilitate the launder of Stake.com’s $41 billion, according to CertiK.

Illicit payment processors that provide services to dark web marketplaces or vendors

Elliptic Report

have also sent over $140 million in Bitcoin through coin swap services. Such payment

processors are particularly used by stolen identity and credit card data vendors – a

criminal enterprise, otherwise known as “carding” that has raked in over $1 billion

in Bitcoin

Elliptic’s report highlights that criminals may be more inclined to using cross-chain bridges as it’s harder for blockchain forensic firms to trace illicit activities across a scalable and programmatic manner.

In addition, criminal’s have shifted to cross-chain hopping services as new assets, such as DeFi protocol specific assets, can only be exchanged through cross-chained bridges.

How Cross-Chain Activities Are Facilitated

In recent times, money laundering through cross-chain activities has become increasingly appealing for criminals due to the rise in anti-money laundering/know-your-customer (AML/KYC) regulations required by traditional exchanges.

The adoption of AML/ KYC regulations has resulted in criminals using unregulated and anonymous exchanges to process their stolen crypto assets. Elliptic’s “State of Cross-chain” report revealed three types of services that are commonly used to facilitate cross-chain activities.These are decentralized exchanges (DEXs), cross-chain bridges, and coin swap services.

At the time of the report, approximately $1.2 billion of stolen crypto funds from DeFi and exchanges had been swapped through DEX’s. This was over a third of all the laundered crypto from Elliptic’s report.

Elliptic’s report also concluded that several decentralized finance (DeFi) services, which convert crypto assets, don’t require ID verification or documentation of their users. The lack of verification policies have made them popular for criminals to launder illicit crypto funds.

Furthermore, $1.2 billion worth of illicit crypto assets have been laundered by criminals through coin swap services. Coin swap services allow users to swap crypto assets within and across blockchains, and there’s no need to open an account. In addition, the report revealed that $540 million in illicit crypto assets had been laundered through Renbridge, a cross-chain bridge.

It’s clear from the findings of the report that there is a rise of cross-chain crimes committed by terrorist organizations. Wallet’s connected to groups that have been sanctioned by the U.S., have laundered over $1.8 billion through these methods.

Terrorist and cyber criminals have resorted to using privacy coins such as Monero “XMR”, to facilitate anonymous transactions. Monero has particularly risen in demand, due to the coins Monero-Bitcoin Atomic Swap, which allows parties to exchange cryptocurrencies without a trustworthy intermediary.

The Future of Cross-chain Services

Cross-chain crime has risen far above the expected rate of crypto analytical firms, with over $7 billion in illicit funds laundered since 2020. However, with law enforcement’s attention drawn to cross-chain services it’s only a matter of time until criminals find a new trend.

Holistic blockchain analysis is one method for law enforcement to simultaneously identify crypto assets on blockchains.

Hey there, I’m a dark web geek who’s been around for the last 8 years. More precisely, I’m livedarknet’s senior content writer who’s been writing about darknet marketplaces, tutorials, and cybersecurity stuff for educational purposes.